japan corporate tax rate 2020

Chapter 3 - Table 32 Total tax revenue in US dollars at market exchange rate Chapter 3 - Tables 37 to 314 - Taxes as of GDP and as of Total tax revenue Chapter 3 - Table 315 - Tax revenues of subsectors of general government as of total tax revenue. Using 1970-2007 data from the United States a Tax Foundation study found that for every 1 increase in state and local corporate tax revenues hourly wages can be expected to fall by roughly 250.

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Corporate Tax Rate in the United States remained unchanged at 21 percent in 2021 from 21 percent in 2020.

. Each country would be eligible to a share of revenue generated by the tax. Corporate - Tax credits and incentives Last reviewed - 29 June 2022. This page provides - Canada Corporate Tax Rate - actual values historical data forecast chart statistics economic calendar and news.

Are you interested in testing our corporate solutions. Population of Japan from 1800 to 2020. Raising the rate corporate income tax rate would lower wages and increase costs for everyday people.

The amendments will apply from tax years beginning on or after 1 April 2022. To enjoy our content please include The Japan Times on your ad-blockers list of. By the introduction of the group tax relief regime under which a member corporation will file corporate tax returns on an individual entity basis the group tax regime was also reviewed by the 2020 Tax Reform Act to be aligned with the group tax relief regime.

Corporate Tax Rate in the United States averaged 3237 percent from 1909 until 2021 reaching an all time high of 5280 percent in 1968 and a record low of 1 percent in 1910. Rates National income tax rate Taxable income Rate JPY 18000001 JPY 40000000 40 4084 including surtax Local inhabitants tax rate 10 plus per capita levy of JPY 4000 and JPY 1000 surtax Capital gains tax rate 1530 203153963 including national surtax and local. The new corporate minimum tax proposal the Corporate Profits Minimum Tax or CPMT would impose a 15 minimum tax on the adjusted financial statement income of applicable corporations that report over 1 billion in profits to shareholders while preserving the value of general business credits eg the research tax credit and allowing.

The main tax incentives in Ireland are. Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels. The global minimum corporate tax rate or simply the global minimum tax abbreviated GMCT or GMCTR is a minimum rate of tax on corporate income internationally agreed upon and accepted by individual jurisdictions.

However for acquisitions made on or after 1 July 2020 any intangible asset acquired by a company will be taxed under the corporate intangibles regime even if. This page provides - United States Corporate Tax Rate - actual values historical data forecast. Corporate Tax Rate in Canada averaged 3757 percent from 1981 until 2020 reaching an all time high of 5090 percent in 1981 and a record low of 2610 percent in 2012.

Prior to 1 July 2020 pre-FA 2002 assets did not come within the scope of the corporate intangibles regime and instead were in most cases dealt with under the capital gains regime. The Corporate Tax Rate in Canada stands at 2650 percent. Change of birth rate in Germany year-on-year 1992-2019.

Total effective tax deduction of 375. All capital expenditure incurred on the provision of specified intangible assets on or after. News on Japan Business News Opinion Sports Entertainment and More It looks like youre using an ad blocker.

125 corporation tax rate on active business income. Please do not hesitate to contact me. The aim is to reduce tax competition between countries and discourage multinational.

A 25 credit on qualifying R. Japan Highlights 2020 Page 4 of 10 Individual taxation. Corporate profits minimum tax.

The Tax Foundation is the nations leading independent tax policy nonprofit.

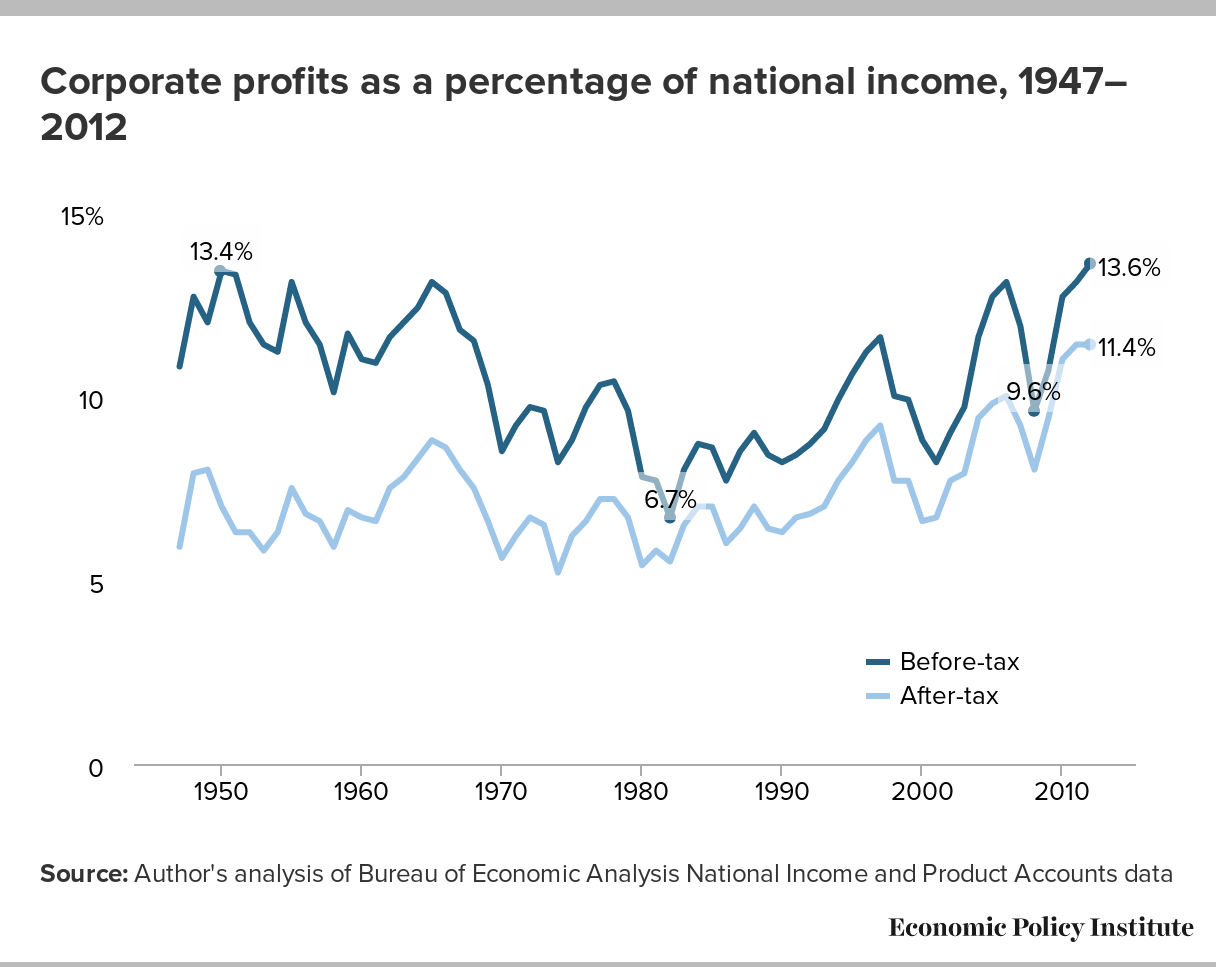

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Corporate Tax Reform In The Wake Of The Pandemic Itep

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Canada Tax Income Taxes In Canada Tax Foundation

The Effects Of Covid 19 On Tax Audits And Controversy Global Employer Services Deloitte Japan

Real Estate Related Taxes And Fees In Japan

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

일본 법인 세율 1993 2021 데이터 2022 2024 예상

What Would The Tax Rate Be Under A Vat Tax Policy Center

Latvia Tax Income Taxes In Latvia Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart

Real Estate Related Taxes And Fees In Japan

Sources Of Us Tax Revenue By Tax Type 2022 Tax Foundation

Malta Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart